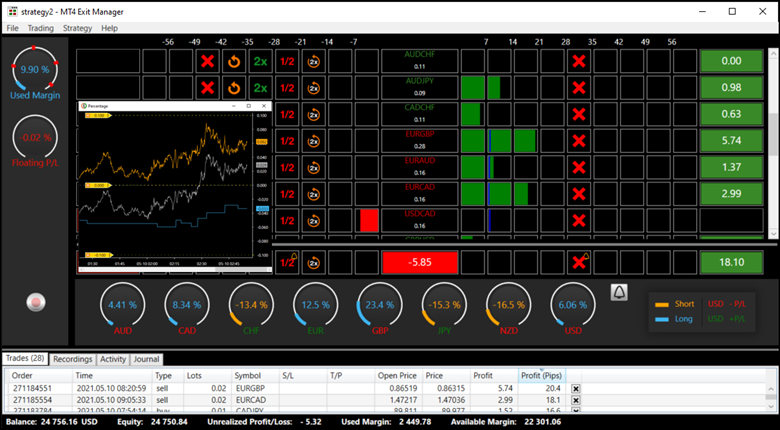

The functions included with MT4 EM provide opportunities to quickly correct the direction of a losing position, adjust trade size, and bring break-even points closer, within a realistic range to gain profits faster, all while keeping risk as low as possible. The topics covered in this tutorial will bring theory to life regarding strategy development with the MT4 Exit Manager Desktop Application.